For years, Elon Musk has been the not-so-secret weapon behind Tesla’s success. His reputation as an indefatigable tech maverick helped to make emission-free vehicles desirable, first for the Silicon Valley crowd then the world. Now, his caustic online presence is considered a liability. But he cannot shoulder all the blame for the carmaker’s problems.

Tesla on Tuesday announced vehicle deliveries in the first quarter had fallen 8.5 per cent on last year, the first year-on-year drop since early 2020. The shares dropped 5 per cent. They are down nearly 60 per cent from its late-2021 high point.

Tesla blames supply problems, pointing to conflict in the Middle East and an arson attack at its Berlin factory. But a gap between production and delivery numbers suggests issues with demand.

Musk’s polarising personality may put some customers off. But multiple research companies have come to the same conclusion in previous years, even as delivery numbers rose. In 2021, Escalent wrote he was a drawback for the brand. Last year, Tesla reported record deliveries, topping 1.8mn vehicles.

The real problem is slowing rates of EV adoption. The stock is priced for nonstop growth. That requires a large customer base, hence Tesla’s transition from high-end, six-figure vehicles to more affordable models and deals with Uber and Hertz. It is targeting a pool of buyers who are more interested in price, range and charging station access than DeLorean style doors and the promise of autonomous driving software.

EVs are still more expensive to make than petrol cars, partly because of the high cost of minerals required for their batteries. Some of the government subsidies that bridged the gap have been withdrawn. Meanwhile, global price wars are hurting all combatants. Tesla cut prices by up to 20 per cent last year amid a proliferation of low-cost vehicles from China.

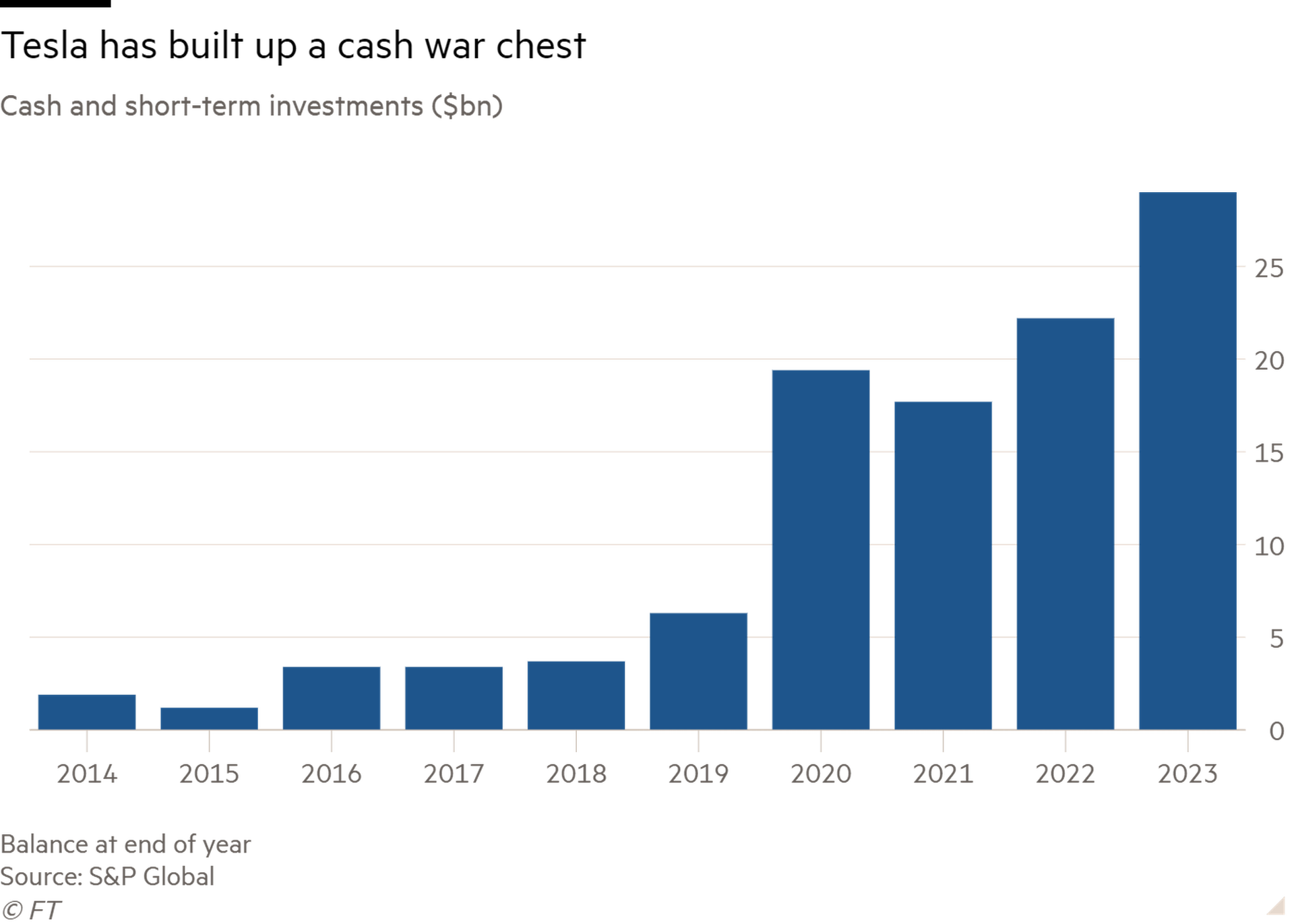

The good news is profitability and high share prices have allowed Tesla to bank funds. At the end of last year it was sitting on more than $29bn in cash and cash equivalents, up from less than $4bn five years earlier. It has the means to see off low-priced competitors while working on charging infrastructure and more affordable vehicles.

Musk’s plans are as bombastic as ever. On the realistic end is a $25,000 vehicle and cheaper assembly process. But one day, he says, Tesla and SpaceX may create something that is not “even really a car”. The Technoking is the reason Tesla remains the most distinctive car company in the world.