尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Dear reader,

亲爱的读者,

The tech sector has a new set of magic words: free cash flow. Even Uber, king of cash burn, is feeling the heat.

科技行业有一句新的魔法咒语:自由现金流。即使是优步(Uber),烧钱之王,也感觉到了压力。

“We need to show them the money,” wrote Uber chief executive Dara Khosrowshahi in a memo obtained by the Financial Times. It is an extraordinary message. Oh, NOW Uber needs to prove it can make money? What happened in the previous 13 years?

英国《金融时报》获得的一份备忘录中,优步首席执行官达拉•科斯罗萨希(Dara Khosrowshahi)写道:“我们需要让他们看到钱。”这是一个非凡的信息。哦,现在优步需要证明它能赚钱吗?在过去的13年里发生了什么?

The question of whether public markets are entering a sustained downturn has focused minds here in San Francisco. If central banks put a definitive end to the era of low rates that made money so cheap, the question is whether growth companies with high valuations will deflate to reasonable levels, or just crash and burn.

公开市场是否正在进入持续低迷的问题一直是旧金山人关注的焦点。如果央行最终终结了让资金变得如此廉价的低利率时代,那么问题就来了:估值高的成长型企业是会跌至合理水平,还是会崩盘烧钱?

Hence the focus on grown-up metrics such as free cash flow, or what’s left over after any investing. Shares in electric car company Tesla are down 39 per cent this year. But speaking at the FT’s Future of the Car conference this week, boss Elon Musk said that his company had a bright future “and I think we will throw off a tremendous amount of free cash flow”.

因此,我们关注的是成熟的指标,如自由现金流,或任何投资后的剩余资金。电动汽车公司特斯拉(Tesla)的股价今年已下跌39%。但上周在英国《金融时报》举办的未来汽车大会(Future of the Car)上发言时,特斯拉首席执行官埃隆•马斯克(Elon Musk)表示,特斯拉拥有光明的未来,“我认为我们将产生大量自由现金流”。

But what do companies do when they have no clear path to profitability? Denver-based data analytics company Palantir tried to get around the problem by riffing on the state of the world.

但是,当公司没有清晰的盈利路径时,他们该怎么办呢?总部位于丹佛的数据分析公司Palantir试图通过反复分析世界状况来解决这个问题。

Markets were not convinced. Its slowing revenue growth does not back up Palantir’s claim of thriving in good times and bad. Shares are down 61 per cent in the year to date. Lex thinks it will require a near-term forecast date for positive net income before Palantir’s shares recover.

市场并不信服。它的收入增长放缓并不支持Palantir公司在顺境和逆境中蓬勃发展的说法。迄今为止,股价在今年下跌了61%。莱克斯认为,在Palantir的股价回升之前,它需要一个近期预测的净收入为正的日期。

New York-based meal-kit delivery service Blue Apron remains profitless after 10 years. This week, it had an even more worrying number to report — sales are half the level they were when it listed in 2017. Lex wonders why RJB Partners is investing $40mn in a private placement. Perhaps it will take the stock private but its behaviour so far has been odd.

总部位于纽约的送餐服务公司Blue Apron在10年后仍然没有盈利。本周,该公司公布了一个更令人担忧的数据——销售额仅为2017年上市时的一半。Lex专栏想知道为什么RJB Partners要投资四千万美元进行私募。也许它会将该股票私有化,但迄今为止,它的行为一直很奇怪。

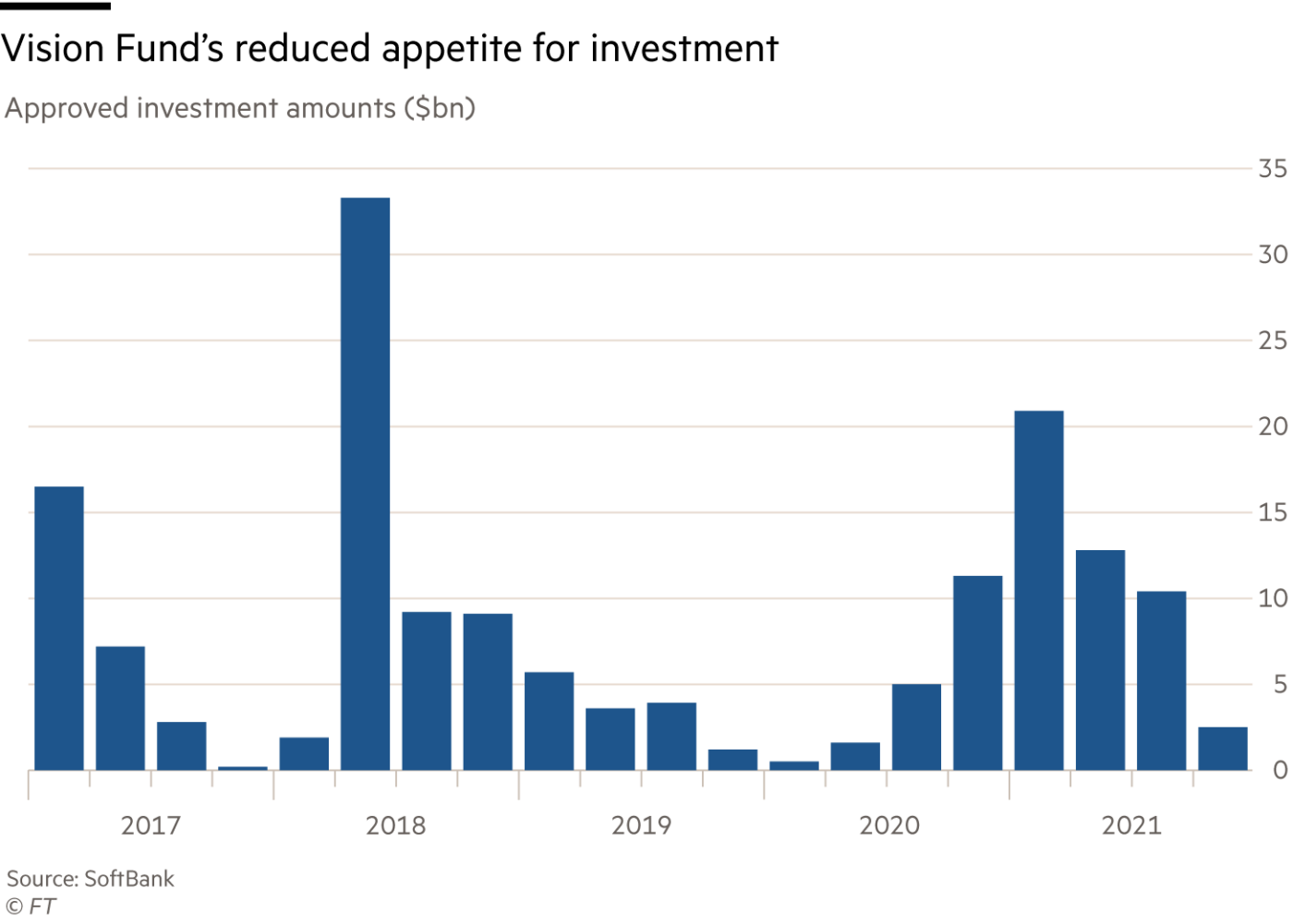

At Japanese technology investment group SoftBank, which has contributed to high tech valuations, Masayoshi Son has put the brakes on its investment pace. Annual net loss has reached ¥1.7tn ($13bn). Lex is curious about what will happen now to the $50bn in capital that has been earmarked for investments.

在日本科技投资集团软银(SoftBank),孙正义(Masayoshi Son)放慢了投资步伐。软银曾经为高科技企业的估值推波助澜。而今,其年度净亏损达到1.7万亿日元(合130亿美元)。Lex专栏对已指定用于投资的500亿美元资金现在会发生什么感到好奇。

Lex does applaud founder Son for diversifying away from China as crackdowns increase. The possible US delisting of Chinese online housing platform owner KE Holdings has also encouraged Son to list it in Hong Kong. That will improve liquidity but do little to solve the real problem: China’s faltering property market.

Lex专栏对软银创始人孙正义在打击力度加大的情况下,撤离中国,到别处进行多元化发展表示赞赏。中国在线住房平台所有者贝壳(KE Holdings)可能从美国退市,也鼓励孙正义在香港上市。这将改善流动性,但对解决真正的问题——中国摇摇欲坠的房地产市场——没有什么作用。

Dating app Bumble is still hung up on using adjusted ebitda — but at least sales are growing. Lex is intrigued by the success of its acquisition of France’s Fruitz, which matches users via the medium of fruit. But adding more users via acquisitions will never take Bumble close to the almost 100mn users that Match boasts. Bumble shares are down 38 per cent so far this year.

约会应用程序Bumble仍然坚持使用调整后的EBITDA--但至少销售额在增长。Lex专栏对其收购法国Fruitz公司的成功感到好奇,该公司通过水果这一媒介来匹配用户。但是,通过收购增加更多的用户,永远不会使Bumble接近Match所拥有的近1亿用户。今年迄今为止,Bumble股价下跌了38%。

Crypto investors have a much harder time pointing to a metric that might support prices. Bad news for US-listed cryptocurrency exchange Coinbase, whose price is firmly tethered to the fortunes of bitcoin, the largest cryptocurrency. Traders are being warned they could lose all of their crypto assets if the company goes bankrupt — a reminder that this sector lacks the safety net of banks.

加密货币投资者很难找到一个可能支撑价格的指标。对于在美国上市的加密货币交易所Coinbase来说,这是个坏消息。Coinbase的价格与最大的加密货币比特币的命运紧密相连。交易者被警告称,如果该公司破产,他们可能会失去所有加密资产——这提醒人们,该行业缺乏银行的安全网。

Speaking of tethered assets — the not-so stablecoin tether fell below the US dollar to which it is meant to be pegged. US Treasury secretary Janet Yellen has called for stablecoin rules and says there is a risk of financial instability. Lex agrees that if Tether liquidates its $34bn Treasury holdings or $24bn of corporate debt there will be market repercussions. That’s if those numbers are correct. We also point out that Tether has been in trouble over its claims before.

谈到加密货币资产——并不稳定的Tether币跌破了它所要挂钩的美元。美国财政部长珍妮特·耶伦呼吁制定稳定币规则,并表示存在金融不稳定的风险。Lex同意,如果Tether清算其持有的340亿美元的国债或240亿美元的公司债,将产生市场反响。这是在这些数字正确的情况下。我们还指出,Tether以前就曾因其债权而陷入困境。

Rising rates may spell doom for risky assets but European banks should be happy. Think again. At just over seven times forward earnings, Lex thinks the sector does look cheap but prone to credit risk should recession take hold in the next year.

利率上升可能意味着风险资产的末日,但欧洲银行应该感到高兴。再想想。Lex认为,该行业的预期市盈率略高于7倍,看上去确实便宜,但如果明年经济衰退持续,该行业可能面临信贷风险。

Tangible assets are still rising in price though. Lex wonders if Andy Warhol prints offer an inflation hedge. Over the long term, prices have beaten inflation. But, of course, the pool of buyers is small and susceptible to impulse spending.

但实体资产的价格仍在上涨。Lex想知道安迪·沃霍尔(Andy Warhol)的版画是否能对冲通胀。从长期来看,价格战胜了通胀。但是,当然,买家群体很小,容易受到冲动消费的影响。

Perhaps chipmakers are a better bet. Integrated device manufacturers such as Infineon and Samsung are busy completing back orders pushed higher by snagged supply chains. Gartner expects a 13.6 per cent increase in global semiconductor revenues this year.

或许芯片制造商是一个更好的选择。英飞凌(Infineon)和三星(Samsung)等集成设备制造商正忙于完成因供应链受阻而推高的延迟订单。Gartner预计,今年全球半导体收入将增长13.6%。

Russia is thinking carefully about its own supply chains as the EU threatens an oil embargo. Hungary wants a carve-out but, even with exemptions, Lex says an EU ban would have clout. Russia’s ability to replace its main customer will be hit by transport constraints. Energy prices are already rising amid the quarrel. Household bills too. Companies such as Centrica may find it increasingly hard to justify raising shareholder rewards, but the UK energy group will probably do so, believes Lex.

在欧盟威胁实施石油禁运之际,俄罗斯正在认真考虑自己的供应链。匈牙利希望脱离欧盟,但即使有豁免权,Lex认为欧盟的禁令也会有影响力。俄罗斯替代其主要客户的能力将受到运输限制的影响。在这场争吵中,能源价格已经在上涨。家庭支出也大幅增加。Lex认为,Centrica等公司可能会发现,越来越难以证明提高股东红利是合理的,但这家英国能源集团很可能还是会这么做。

Oil market turmoil could accelerate the transition to clean energy. Shareholders are putting more pressure on global companies to make the change. Not BlackRock, though. The goliath of fund management is swerving some climate change resolutions. But as Lex points out, this is not such a radical decision. BlackRock supported less than half of environmental and social shareholder proposals last proxy season. Still, it is an unwelcome step back.

石油市场的动荡可能会加速向清洁能源的转变。股东们对全球公司施加了更大的压力,要求他们做出改变。不过,贝莱德没有。这个基金管理的巨头正在回避一些气候变化的决议。但正如Lex所指出的,这并不是一个如此激进的决定。贝莱德在上个代理季支持了不到一半的环境和社会股东提案。尽管如此,这仍然是一个不受欢迎的退步。

Enjoy your weekend,

祝您周末愉快,

Elaine Moore

伊莱恩·摩尔(Elaine Moore)

Deputy Head of Lex

Lex栏目副主任

If you would like to receive regular updates whenever we publish Lex, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

如果您希望在我们发布Lex时收到定期更新,请将我们添加到您的FT文摘中,我们每次发布时,您都会收到即时电子邮件提醒。你也可以通过网页看到Lex的每一篇专栏文章