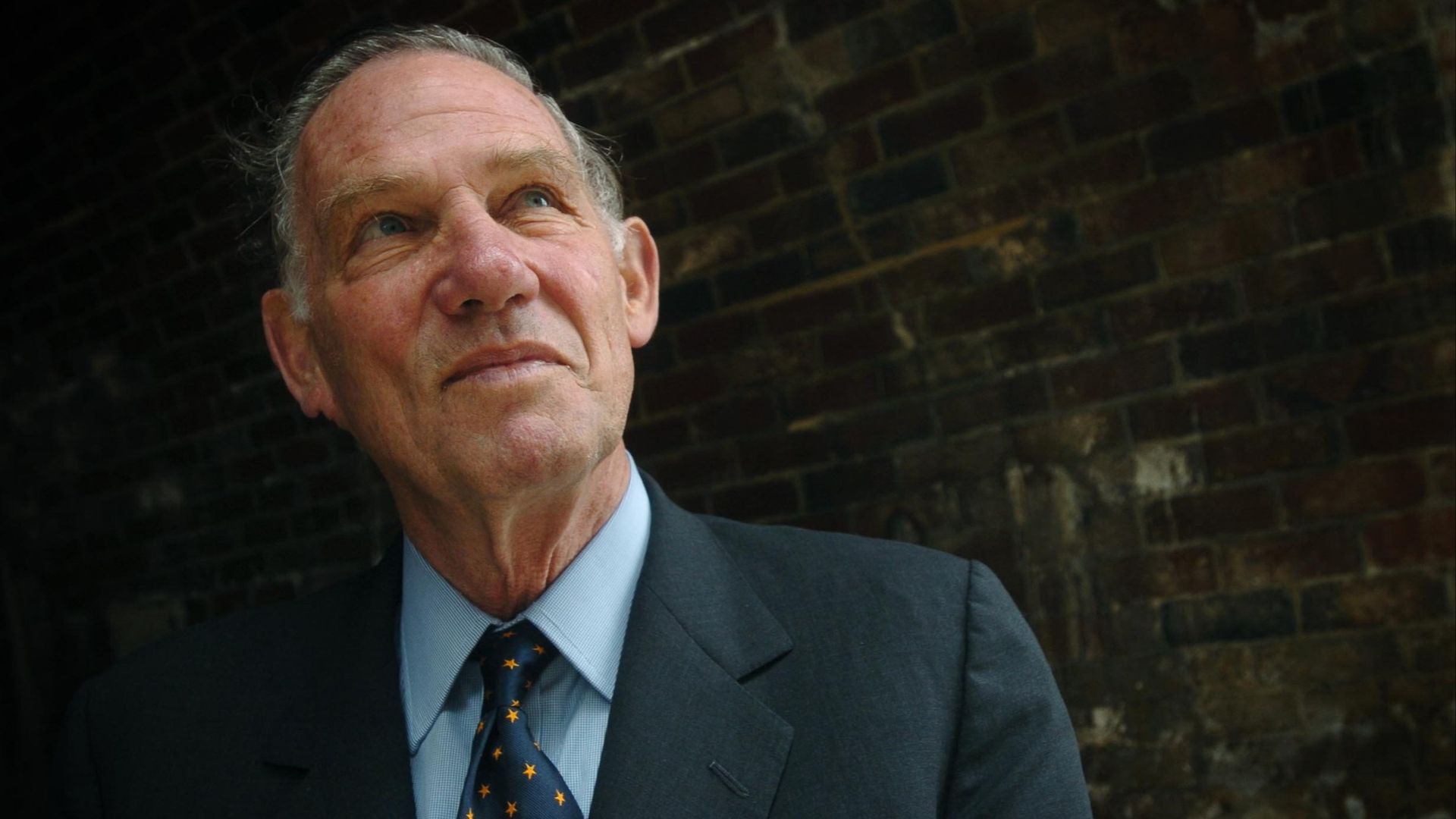

Robert AG Monks, who has died aged 91, was the inspirational founding father of American shareholder activism, an accomplished lawyer, prolific writer and successful businessman. With Nell Minow, his long-standing business partner and co-author, he helped power the take-off in the 1980s of the corporate governance movement.

Monks was a Republican who ran three times, unsuccessfully, for the US Senate. He liked to remind people that it was while running for office that he came to understand the critical importance of institutional shareholders in democracy. As a result of heavy pollution in a river close to his home in Maine, he realised that corporations overwhelmingly determined the quality of the air we breathed and the quality of the water we drank. Yet, they were not properly accountable to owners.

This inspired Monks to become an initiator of what we now know as the environmental, social and governance agenda. His was essentially a stakeholder view of capitalism. He argued that the unrestrained hunt for profits was taking a toll on society. Institutional shareholders should require management to move beyond short-term profit maximisation and act in a socially and environmentally responsible manner to ensure sustainable value for the future.

Such “wokery” enrages leaders of today’s Republican party. Monks always declared himself a proud Nelson Rockefeller-style Republican — economically conservative but socially liberal. O tempora, O mores, many will sigh.

Robert Augustus Gardner Monks was born in Boston in 1933, the son of an Episcopalian priest. He was blessed with wealthy ancestors and educated at Harvard and Cambridge, where he rowed in the Oxford and Cambridge boat race in 1955 — Cambridge won.

After a period as a partner in a Boston law firm he went into business. Making money came easily to him — conspicuously so when he sold the Boston Company, a fund management group he chaired. He was then invited by President Ronald Reagan to serve at the Department of Labor, having jurisdiction over the entire US pension system.

This background in law, business and government helps explain why, Minow suggests, Monks was the first to see that the rise of fiduciary institutional investors had the potential to revitalise the foundation of capitalism. Widespread share ownership through pension schemes made investment a social and political concern. He believed that capitalism without responsible owners would fail. Hence his decision in 1985 to found Institutional Shareholder Services, facilitating voting by institutions to make management accountable. Now the leading proxy firm, it is under attack for allegedly “woke” recommendations to clients.

Monks also founded the Lens investment fund as a vehicle for activism. His fortune was an undeniable asset here. In submitting dozens of shareholder proposals, he spent thousands on litigation, proxy issues and board campaigns. Another striking example of his financial firepower was the campaign to win a seat on the board of Sears Roebuck, the ailing retail giant turned conglomerate. He claimed that Sears spent millions in keeping him off the board. His retaliation famously included a full-page advertisement in The Wall Street Journal that accused the board of being “non-performing assets”.

Monks continued to advise institutional shareholders through his last significant venture, ValueEdge Advisors. By this time he was obliged to recognise that his vision was being subverted by overweening corporate power. Wall Street, the Business Round Table and other lobby groups had long held a financial armlock on Capitol Hill. This grip was immeasurably strengthened by the Supreme Court judgment in 2010 that removed political spending restrictions on corporations, resulting in a decisive tilt away from shareholders towards boards.

Later in life, Monks talked of the corporate capture of the American dream and the twilight of corporate governance. Yet his campaigning was not in vain. The number of companies that have decided to split the roles of chair and chief executive has risen steadily since 2000. Shareholder activism is now a central feature of capital markets. And many of his campaigns against imperial CEOs succeeded in improving governance practice.

Minow told me this week: “When I met him he wanted to ‘wake the sleeping giants’ and I think it is fair to say, with some setbacks and a lot more to do, with the creation of four companies, plus innumerable articles and several books, he did.” I and countless others feel privileged to have known this charismatic visionary.