American meat eaters may not have heard of JBS, but chances are they have sampled its wares. Now, the Brazilian meat processor, the largest in the world, wants them to sample its shares, too.

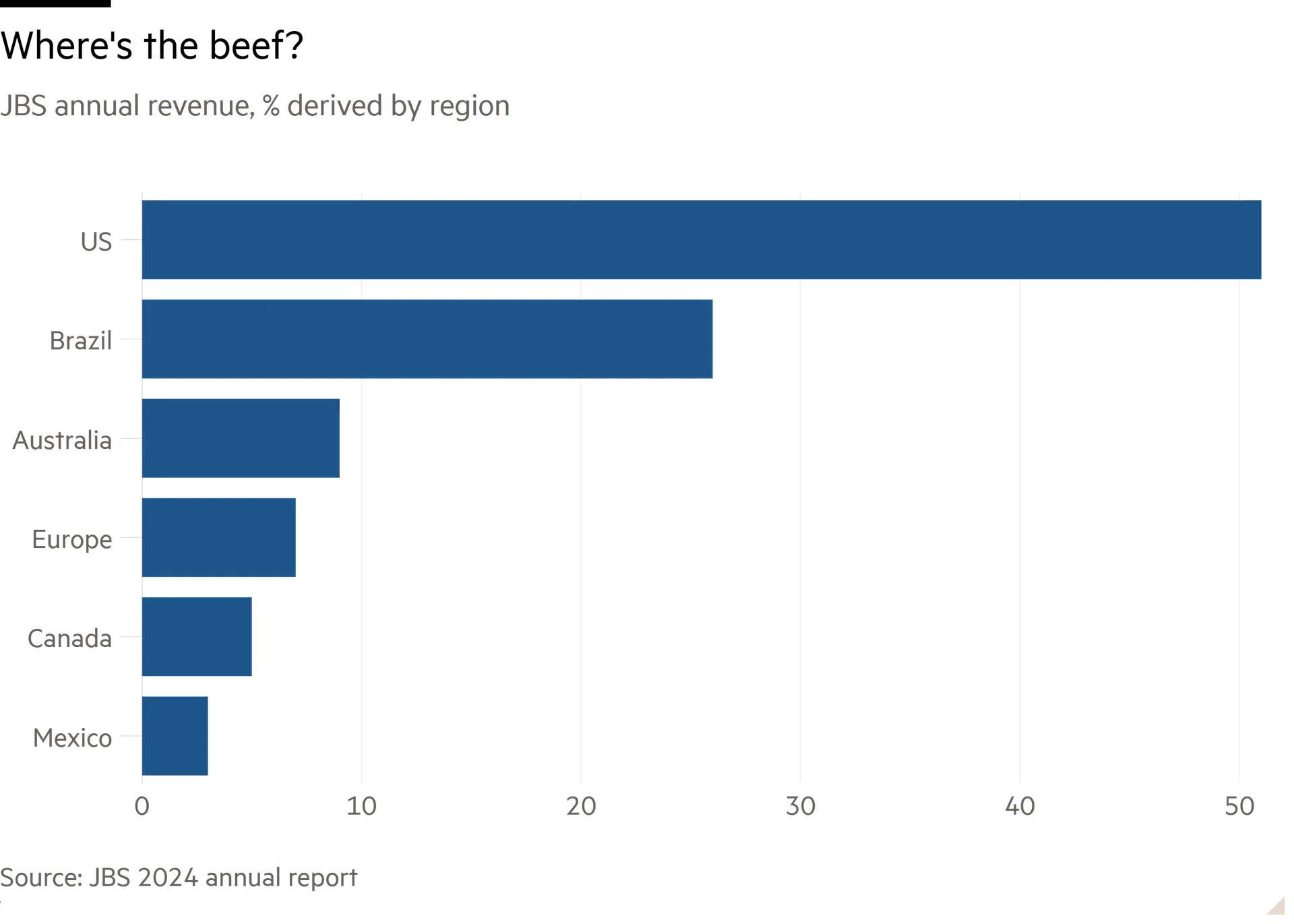

JBS supplies much of the beef, pork and poultry that ends up on American plates, and the reliance is mutual. More than half of the $77.2bn in revenue it pulled in last year came from the US. That exposure is one reason the company has long coveted a US share listing. Having pursued the idea on and off for close to a decade, the company finally got the green light from regulators and its shareholders to move its main stock listing from Brazil to the US.

The company thinks the move will help its stock, which trades at a sharp discount to US rivals, fetch a higher valuation as well as give the company access to cheaper funding.

The shares will not be palatable to everyone, though. The founding Batista family, through its investment vehicles, is the largest shareholder in JBS with a 48 per cent stake. The planned issue of supervoting shares, offered disproportionately to the Batista family, could leave it with 85 per cent of votes.

Shareholder advisory firms ISS and Glass Lewis both recommended holders of JBS’s current Brazilian shares to vote against the dual listing — to no avail. Long-standing environmental concerns over the impact of cattle ranching on the Amazon rainforest and a bribery scandal that resulted in the US Securities and Exchange Commission hitting JBS and the Batista brothers with multimillion-dollar penalties could keep the shares off the menus of ESG-minded institutional investors.

Even without these oddities, selling meat is a tough business. High grain and cattle prices are driving up costs for meatpackers. A tough economy also means the scope to pass on the higher costs to consumers has become more limited. While 2024 revenue at JBS was up by a fifth since 2021, profitability is 50 per cent lower.

Despite the run-up in share price in the wake of its US listing approval, JBS currently trades on just five times EV to ebitda. By contrast, Tyson Foods is on a multiple of nine times, while Smithfield Foods and Hormel Foods are on seven and 12 times, respectively A US listing, by virtue of potential index inclusion and lower funding costs, should help narrow this valuation gap.

Even then, compared with US rivals, JBS’s business mix leans more towards low-margin beef processing instead of higher-margin processed foods. Acquisitions might help. To close the valuation gap fully, Brazil’s king of beef will have to change much more than its stock market listing.