The market for new listings reheated somewhat in 2024, but has yet to fully crisp up. China’s WH Group hopes it can help: by relisting US pork producer Smithfield Foods. WH ought to keep its expectations lean.

WH, the world’s biggest pork purveyor, took Virginia-based Smithfield private in 2013. At the time, its $34 a share cash offer valued Smithfield’s equity at $4.7bn and represented a hefty 31 per cent premium over the prior day closing price. Now it is looking to sell up to 20 per cent of the company, and return it to US investors’ portfolios.

Back then, paying top dollars for America’s biggest pork processor might have been justified by expectations that China’s growing middle class — tired of repeated food safety scandals — would stump up for safer American meat products.

But that narrative didn’t quite pan out. Exports to China took a hit after President Donald Trump’s trade war during his first term prompted Beijing to retaliate with a 25 per cent tariff on all US pork products. A second Trump administration could further inflame this. The Chinese economy’s post-Covid slowdown has emerged as an additional challenge.

Culturally, Chinese consumers prefer to buy fresh — rather than frozen — pork, giving an edge to domestic producers. Packaged pork products — like the American-style bacon and lunch meats that make up a big chunk of Smithfield’s sales in the US — never quite took off in China.

With little apparent overlap between the two companies, small wonder WH is looking to relist Smithfield in the US again.

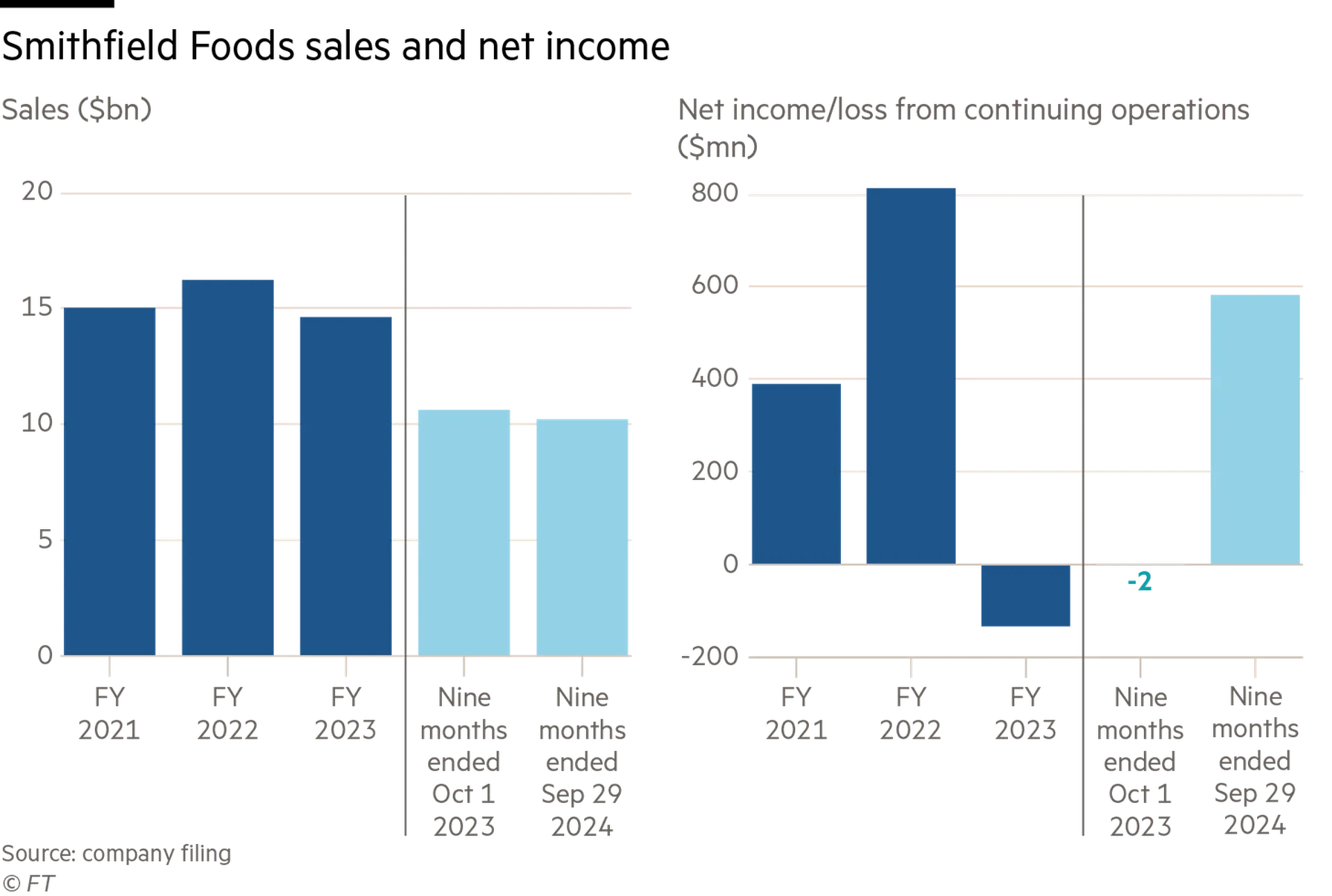

Yet the Smithfield being taken public is geographically smaller than when WH bought it over a decade ago. WH carved out the company’s European operations in August and kept it as one of its subsidiaries. The Smithfield on offer is made up of just the US and Mexico businesses. And performance has been lumpy.

Smithfield’s packaged meat division is much more profitable than it was in 2014 — its operating margin has more than doubled to 15 per cent in the first nine months of 2024. Yet the similarly sized fresh pork business has a margin of just 3 per cent. Its hog farming division has struggled with high feed prices and oversupply.

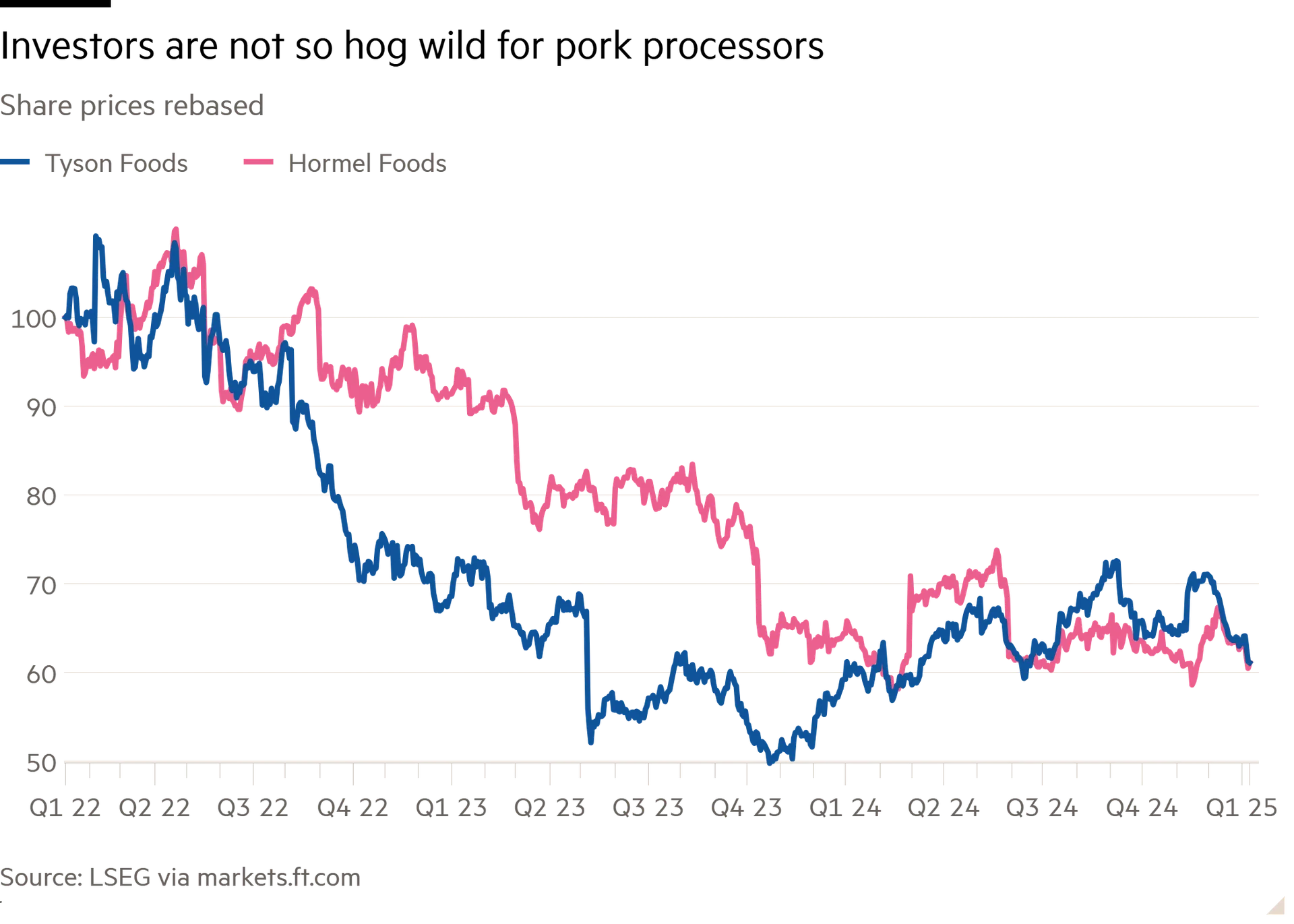

Lower grain costs will help improve the bottom line for 2024. Even so, a pure play on American and Mexican appetite for pork is a tough sell — especially one that will remain controlled by its Chinese parent. Shares in rival meat packers and producers such as Hormel Foods and Tyson Foods have underperformed the wider market. Brazilian meat giant JBS’s plans for a US listing have suffered repeated delays.

In a market that has gone wild for artificial intelligence and speculative technologies, Smithfield is at least serving a familiar business model that customers and investors can get their teeth into. Its valuation will just need to reflect that reheated bacon isn’t to everyone’s taste.